International copper prices have seen a slight increase after China announced major investments in Africa’s power grid, but the rally may be short-lived due to technical factors and uncertainties in the global economy.

China’s investment and the role of copper in the energy industry

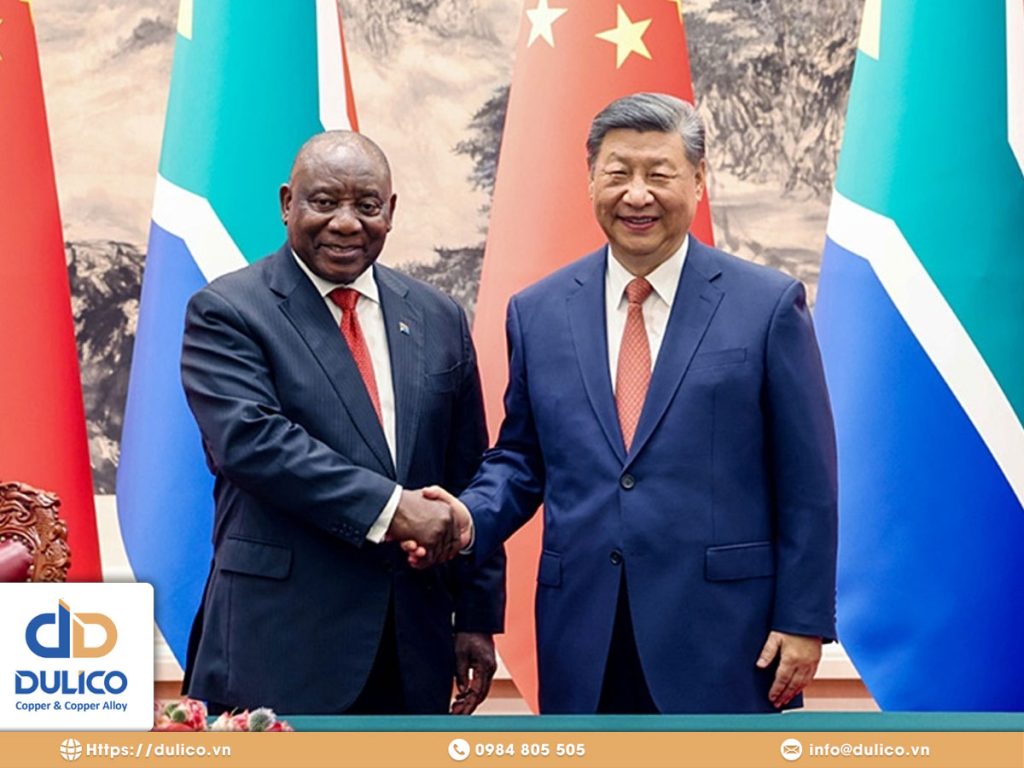

China, the world’s second-largest economy, has pledged nearly $51 billion to build and upgrade Africa’s power grid. The investment is focused on developing energy infrastructure, including power transmission and developing wind and solar power plants. Copper is a key ingredient in this process, thanks to its superior electrical conductivity, which has led to increased demand for copper.

The increase in investment in power infrastructure, especially renewable energy, has boosted demand for copper. This helped push copper prices on the London Metal Exchange (LME) up 0.6% to $9,016 a tonne – a positive sign after a difficult period for the metal.

Technical factors and economic uncertainty

Despite the short-term recovery, analysts say copper prices are facing technical constraints. Some predict that copper prices could fall back below $9,000 a tonne in the coming period. A trader said that most other metals in the market have returned to prices before the strong rally in May, and copper could follow a similar trend.

In addition, macro factors are also creating uncertainty for the copper price outlook. Industrial production in major economies such as the US and China is weakening. Manufacturing activity in the US contracted slightly in August, while Chinese manufacturing fell to a six-month low. This has had a major impact on demand for copper and other metals, as the manufacturing industry is one of the leading metals consumers.

Copper Price Trends and Global Factors

While copper prices have risen slightly due to the impact of Chinese investment, the long-term outlook for the metal remains heavily dependent on developments in the global economy. If major economies continue to weaken, demand for metals, including copper, could decline, leading to a decline in prices.

In addition, China will soon release important economic data on trade, inflation and credit in the coming period, which will help shed more light on the outlook for copper and other metals demand. This outcome will be a deciding factor in whether copper prices can maintain their upward momentum or continue to be under downward pressure.

Other Metals SituationAlong with copper, other metals such as zinc, aluminium, nickel and tin also saw their prices fall. Zinc prices, for example, fell 2% after Russia’s major zinc miner Ozernoye resumed production earlier than expected. Aluminium, nickel and lead prices also fell, reflecting the difficult situation in the metals market.

Dulico – Short introduction 27/09/2021

Dulico – Short introduction 27/09/2021Dulico, a leading company in Vietnam, specializes in manufacturing brass strips and copper alloy strips using continuous casting technology. Watch more about DULICO: To receive...

Rising Copper Prices: Challenges, Opportunities, and New Directions for Manufacturing Enterprises

Rising Copper Prices: Challenges, Opportunities, and New Directions for Manufacturing EnterprisesIn recent months, the global metals market has been witnessing a strong upward cycle in copper prices — a core...

Stranded Copper Wire – Classification, Standards, and Technical Applications

Stranded Copper Wire – Classification, Standards, and Technical ApplicationsStranded copper wire is a specialized electrical conductor composed of multiple fine strands of refined copper twisted or braided together...

DULICO joins FBC ASEAN 2025

DULICO joins FBC ASEAN 2025On September 17, 2025, DULICO took part in the FBC ASEAN 2025 event. This was an opportunity for us to...

DULICO to Participate in FBC ASEAN 2025 – Connecting for Breakthroughs

DULICO to Participate in FBC ASEAN 2025 – Connecting for BreakthroughsDULICO Co., Ltd. is pleased to announce its participation in FBC ASEAN 2025 – The International Manufacturing Business Matching Exhibition,...

DULICO TO PARTICIPATE IN MTA VIETNAM 2025 IN HO CHI MINH CITY

DULICO TO PARTICIPATE IN MTA VIETNAM 2025 IN HO CHI MINH CITYDULICO Co., Ltd. will be present at MTA Vietnam 2025 – the premier international exhibition for manufacturing and supporting industries,...

To receive a quotation and detailed consultation on products and technical specifications, please contact:

| Mr. Doan Thanh Tung (David) International Sales 📞+84 975 441 115 ✉️ tung.doan@dulico.vn | Mr. Nguyen Trong Duy (LEO) Director ✉️ duy.nguyen@dulico.vn |